Some weeks ago, I presented hard evidence to prove that esports are very promising for broadcasters, especially due to audience growth and the monetisation opportunities available.

Now, it’s time to check who watches digital esports and how they do so to better understand the habits of this group.

A stereotype-busting range of ages

While gaming may sometimes be viewed as a novelty, it has been present in popular culture since way back in the early 70s – back when Pong was released by Atari. Since then, thanks to the rapid development of technology, games are a popular pastime for many people across the globe. And not necessarily just young people.

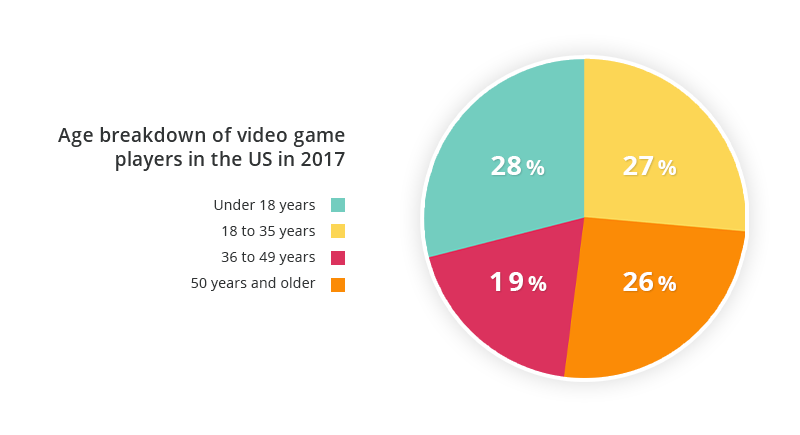

This is how it looks in the US, regardless of gender:

In the above, the 26% of 50+ gamers may remember playing the original Pong, released in pre-internet times and when Richard Nixon was in the Oval office! With almost one-third of players under 18, it looks as though games continue to have a presence throughout someone’s whole life. Most likely, today’s under-18 gamers played their first games on a smartphone or other mobile device however!

Elsewhere, other research has shown that the average gamer is 35 years old – with female players at 37 years old and male ones at 33[2]. These stats alone are enough to make you rethink this audience.

Females play too!

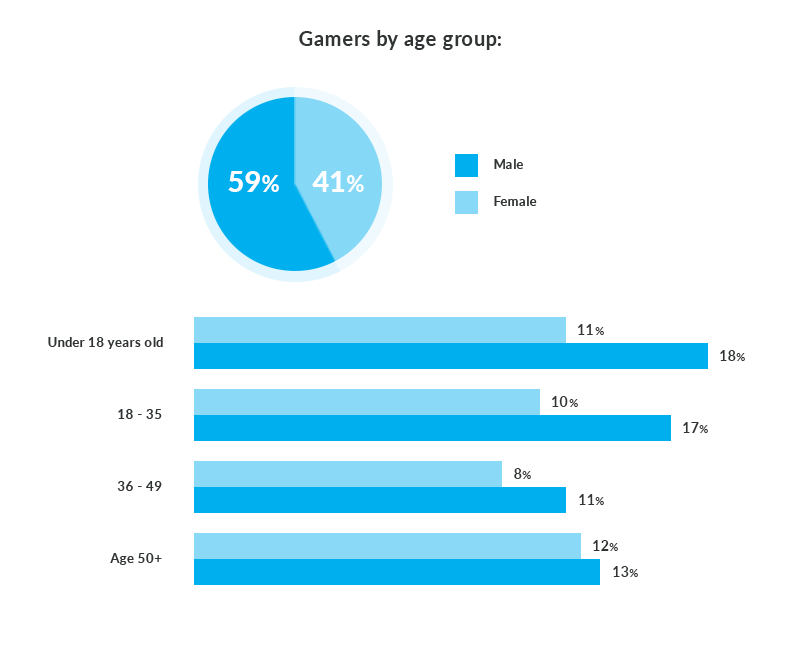

While the common stereotype of a gamer often refers to them as male teenagers or young men, the reality is a bit more complex. Women have a strong presence in gaming communities – 41% of US video game fans are women. This is compared to 59% men across all ages:

Gaming devices are widespread

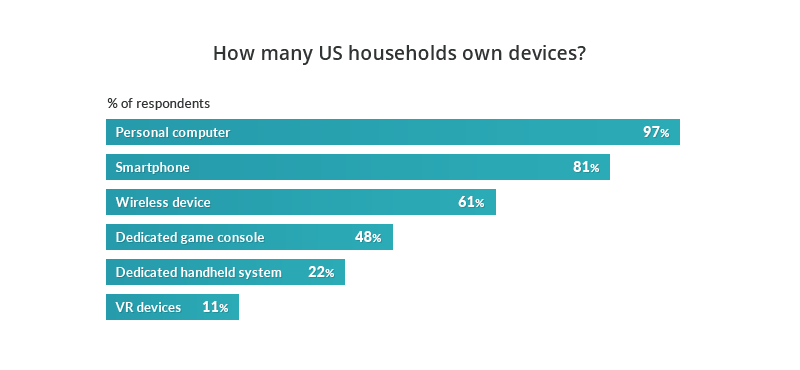

In the US, 67% of households own a device that is used to play video games – either a PC, smartphone, wireless device, game console, handheld system or virtual reality device. In 65% of these US households there’s at least one person who plays three or more hours of video games a week. [4]

What’s worth a mention here is that gaming devices are very often ‘watching’ devices at the same time. PCs, laptops, smartphones and tablets are multipurpose and very often used as second screens.

To game, or just watch?

There are a lot of similarities between fans of traditional sports and esports. Like this one – that they will often prefer to watch events than actually play the sport (or esport) themselves. According to research by Newzoo, which focused on three of the most popular esports franchises – League of Legends (LoL), Counter-Strike: Global Offensive (CS:GO) and Dota 2 – [bctt tweet=”42% of esports viewers do not play the games they watch.” username=”TellyoTV”]

There are further similarities, with 70% of esports fans surveyed by Newzoo watching only content dedicated to one of the three games mentioned above.

So, how many sports are you following or how many teams do you actively support?

Esports fans aren’t very lavish… yet

The average spend by esports fans on their hobby is $3.64. Another $0.33 should be added as revenue from merchandise, event tickets and subscriptions. All in all, that’s not a great deal of spend, especially bearing in mind the huge prizes available at esports tournaments.

But this rapidly growing market isn’t saturated like traditional sports. For comparison – the average global revenue for a basketball fan is $15 per year, while $54 for all sports.

So, what’s behind such a big difference between esports and traditional sports?

- Esports are popular, but we’re unable to compare their popularity to traditional sports just yet.

- Traditional basketball, football or hockey leagues, for example, are often very well organised. They will have lots of sports events throughout the year and most countries will have their own leagues and cups etc.

- Merchandising in traditional sports is huge, bringing enormous profits to teams, sponsors and partners.

- Youth training systems are often in place for well-established sports – for example, football academies offer more structure for young players.

- Traditional sports get more publicity – their most popular players are pop-culture stars and recognisable around the world.

- Years of tradition – something esports naturally lack for now.

Revenues look to be rising

Average esports revenue per fan is growing and is optimistically forecasted to hit 3 billion dollars globally in 2020. This would count for $11 revenue per fan – which is quite an amount![5]

What’s fuelling such optimistic forecasts regarding future revenues from esports? Let the numbers speak:

- 43% of esports fans in US are earning $75 000 or more annually.

- 31% of esports fans in US have an annual income reaching $90, 000 or more.

According to the same survey, 57% of esports enthusiasts are over 25 years old and live with their children. Can we assume that someday they will pass their passion to younger generations? Well, we can’t foresee this for sure, but it seems pretty plausible[6].

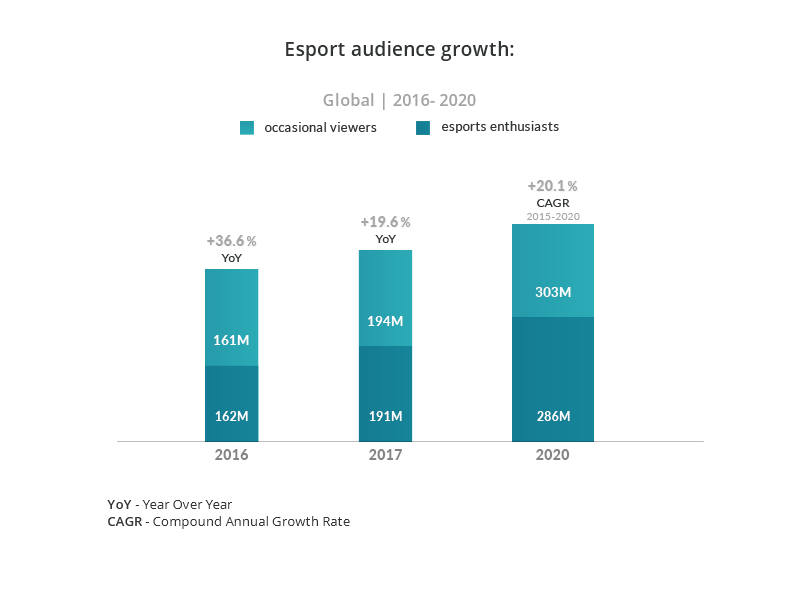

A growing audience

Esports are gaining in popularity very quickly. Some predictions suggest that in 2020 there will be 286 million hard-core, esports enthusiasts and more than 300 million occasional viewers globally. Combining these two figures gives you some idea just how big esports might be in the coming years.

Interesting prospects

Beyond any doubt, esports fans and gamers are interesting prospects now and into the future. They represent a massive audience that brands, broadcasters and rights holders can tap into.

As an audience, esports fans and gamers are:

- Demographically diverse, with some surprising audience segments.

- Like traditional sports fans in the way they are often loyal to only a few favourite titles.

- Rising in numbers, with audience growth continually expanding.

- Limited in ways they can show their support and love for esports with their wallets, besides watching streams and buying and playing games.

As a new type of entertainment, esports are still in a nascent stage – and the world of traditional sports can look saturated in comparison. Esports’ popularity is rapidly growing and there’s still time to jump on the bandwagon before it moves too fast like the flick of a gamer’s thumb.

[1], [2], [3], [4] Source 1,2,3,4

[5] 2017 Global esports market report, Newzoo